Dear Valued Clients and Friends,

As I am typing on Friday morning, the Dow is down about -600 points on the week (-1.7%), the Nasdaq is down -3.3% on the week, and -7.5% since its July high. More importantly, the long bond (10-year Treasury) yield, which was as low as 3.3% in April, is now just a whisker short of 4,5%. 38 basis points have been added to the 10-year yield in just the last month.

I prefer to write about what to look for in an advisor, or basic principles against market speculation, or even the unfolding economic challenges in China. A mere “down week” in markets is no reason to make the Dividend Cafe a “latest in the markets” site, and in fact, there are ample financial pornography sites willing to bait you for clicks along those lines. But actually, the inspiration for this week’s Dividend Cafe is not “why markets were down this week or this month” – but rather something more substantial and thematic. There are some “whys” that are more important than “whats” right now and big picture, I felt certain macroeconomic themes we are watching were worth a whole Dividend Cafe.

That verbiage makes it sound kind of boring, but really, I am just under-selling the excitement of what lies ahead for those who jump into this Dividend Cafe … You will not want to miss the drama and fun. Off we go …

|

Subscribe on |

What has changed?

It is probably too simplistic to summarize markets over the last year or so this way, but I will give it a shot anyways:

(1) More or less, markets realized in early 2022 that the economy was weakening. The first thing was to take shiny objects to the woodshed, and that mercy-killing got out of the way early in the cycle.

(2) By mid-2022, it was clear that the Fed was going to tighten more than expected. That led to a market sell-off AND the assumption that the Fed would create a recession. Perma-bears who have predicted twenty of the last two recessions took to the pages of their newsletter to call for a recession (courage!), and even those skeptical of economic bearishness assumed a recession was more likely than not.

(3) By late 2022, markets began to price in the idea that the Fed was near the end of their tightening. Market actors who had seen this play before assumed that markets would discount the next steps sooner than later and began taking on more optimistic positions.

(4) Into 2023, the recession discussion began to take on a “will we or won’t we” theme as opposed to “we will, but how bad will it be.” By mid-2023, the odds were more in favor of “no recession” than even a “mild recession” – and markets began to price in the “soft landing” outcome – a Fed that reverses tightening and that avoids recession all at once.

(5) Over the last month or two, markets have begun to say, “Wait a second, what if we do avoid recession, but the Fed just stays tight for a long time and valuations get no boost, risk-free rates stay high, and liquidity stays lacking …” Bond markets have beaten equity markets to pricing in that scenario, but equities have played quick catch-up.

And here we are. A market that went from fearing recession to being excited about no recession to now wondering if we get a market problem even in a non-recessionary scenario. Good times.

Fed said what?

Chairman Powell said this week that the neutral rate has moved higher. The neutral rate is this undefinable, mythical, non-controllable, arrogant concept where a policy rate above it is restrictive of economic activity, and a rate beneath it is stimulative for economic activity. I have been a critic of the idea of manipulating policy around the neutral rate since I studied the basic reality (with 150 years of precedence now, but it was GFC for me) that the policy rate does not trump insolvency. In other words, if your counter-parties are all going bankrupt you do not say, “well, if I can borrow at 1% I will give this bankrupt group my money” – you just don’t do anything no matter what the cost of capital. I would point out that a lot of very productive projects got done in the second half of the 1980s at very high rates. Cost of capital matters, but the Fed’s belief in a neutral rate as the axis on which the economy pivots is spiritual buffoonery and hubris.

The Fed does not know what the neutral rate is. The market is now realizing that. They believe they need to alter economic activity with their policy tools and do not understand why markets do not see it their way. It is a confused project, leading to mixed (confused) responses.

Productivity

My friend, Rene Aninao of Corbu Research, has a brilliant theory as to what the fly in the ointment is. Either productivity is higher now, or, in the Fed’s models, expected higher productivity leads one to require a higher neutral rate assumption. If this were true, and if sustainable, it would assume a higher fed funds rate for some time, more capital coming into the U.S., a stronger dollar, and, yes, a capex boom in the U.S.

My agreement with Rene is on the capex side and the productivity side. I think there needs to be and will be a boom in those elements of the economy and that it will be connected to an industrialization that many have assumed was dead and gone.

But will it lead to a higher rate environment forever?

Not so fast.

Quantitative Tightening – two long words

Our culture does not like long books anymore, it does not like long articles, and it does not like long movies. TikTok Reels get more eyeballs than long documentaries. Tweets get more eyeballs than white papers. And blogs get more eyeballs than books. It can be debated if we are getting dumber or just losing our attention span (as if those two things are mutually exclusive), but it is a fact that simplicity and brevity are valued more than complexity and elaboration.

My theory about “quantitative easing” and “quantitative tightening” is that they are not only conceptually more complicated than “lower rates” or “higher rates” but that they just plain sound more complicated. They sound technical. They sound boring. The fed funds rate is a different policy tool than what the Fed does with its balance sheet – they are each different tools doing different things, and yet they are both part of the monetary policy conversation over the last fifteen years, except not really. The policy rate (fed funds) gets all the attention, and “quantitative tightening” is assumed to be a secondary or peripheral nuisance in the discussion. “Just stick to the short words – what is the Fed doing with rates?”

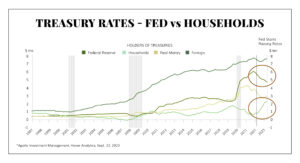

But here’s the thing. The Fed has $1 trillion less Treasury bonds than it did a year ago, even as the Household sector has over $1 trillion more. So that removal of treasuries from the Fed balance sheet (big word alert: quantitative tightening) is really a non-event, right? Because the household sector replaced the Fed, it is potato-potahto?

Not so fast! The Fed was buying Treasuries “non-economically” – that is, they were not in pursuit of the yield they offered. They didn’t care. That was sort of the whole point. Enable the long end to flatten because the marginal buyer didn’t need a higher rate to hit the buy button. Fair enough. But the replacement of the central bank with households over the last year is not apples-to-apples. Households care about the yield. The increased appetite for Treasuries comes from economic buyers, so the deciding factor in this playing out of quantitative tightening is …

Higher rates at the long end.

If it can’t it won’t

Fundamental to the higher for longer thesis is confidence in a depoliticized and non-politicized Fed. Politics aside, it requires a belief in a break-up of the Fed-Treasury accord that has dominated American economic life since the Great Financial Crisis (and dominated Japanese economic life for longer than that). I don’t believe it. I want to. But I don’t.

Capex, productivity, and positive economic activity get you a lot – they are really all I care about. But excessive government debt that cannot be paid at 5% (let alone 6%) rates is the elephant in the room. And I believe the need for the Fed to abandon quantitative tightening to bring down borrowing costs for its quasi-employer is inevitable.

When? I do not know. Soon? Yes, I think so. I can only, at best, have a very fallible outlook here. We are in the domain of the unpredictable. But a net interest cost going to 7% of tax revenues from 3% will not be resolved by higher taxes. And if it does, trust me, the productivity boom is not going to happen.

This remains the pickle of our day – fiscal policy needs more accommodative monetary policy, but high productivity calls for less accommodative monetary policy; and if fiscal policy is changed to be in line with less accommodative monetary policy, then lower productivity results and calls for more accommodative monetary policy.

A tangled web we weave when first we practice to intervene in economic affairs with experimental policy tools.

Government shutdown

I am firmly on the side of history that government “shutdowns” do not matter for markets. In my lifetime, we have had twenty such shutdowns (geez, I am only 49 years old!). The average length of each one was a whopping eight days. Several have been shorter and a few longer, but you get the idea. Since 1980 the market was only down in three out of fourteen shutdowns, and in those three cases, the average drawdown was about -2%. 80% of the time, the market was up during the shutdown.

Now, even an ardent opponent of drama and historical revisionism like me is open to the idea that this time may be different. It would not be the drama of a shutdown, per se, that added to market drama, but rather a combination of events and circumstances just creating a lack of buying. In other words, the shutdown combined with the hawkish Fed, the UAW strike, the growing deficits, and Chinese growth concerns may serve to, in total, create a moment of pause for would-be buyers. I wouldn’t bet on it, but I certainly wouldn’t be surprised by it. And I absolutely wouldn’t invest around it – we know how that goes!

Case in point

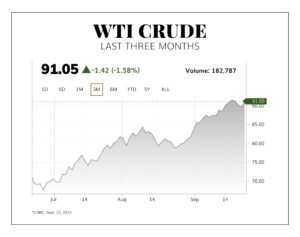

Remember the beginning of the year (a long, long time ago) when the basic assumption was that China would be re-opening to massive economic demand, and that would put upward pressure on oil prices?

What happened? The opposite, as it pertains to Chinese economic growth in 2023.

So oil prices tanked, right?

Nope. Not even close. A +30% move higher in the last three months as China’s economic picture has worsened the most.

Premises, conclusions, and moving from premises to conclusions – it’s not as easy as it looks.

Conclusion

Markets are, in the short term, digesting a lot of things right now. Some are good, some are bad, and there will be ongoing volatility.

But long-term, the question for markets – stock and bond alike – is whether or not the Fed is in it for “higher for longer” – with both their balance sheet and the fed funds rate.

And I know where I believe that is going, one way or the other.

Chart of the Week

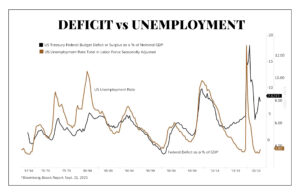

The utter tragedy of modern fiscal policy in one chart. I do not believe in expanding government deficits in time of economic weakness, but that argument is essentially consistent with Keynesian orthodoxy that when the economy needs a boost, the government can provide a counter-cyclical boost to aggregate demand. But. That. Is. Not. What. We. Are. Doing. For the last ten years, our deficits have exploded even in low unemployment, high consumer activity, and no real need for Keynesian stimulus.

Milton Friedman said it best – there is nothing so permanent as temporary government programs (or spending). And this is bi-partisan, I assure you.

Quote of the Week

“Productivity isn’t everything, but in the long run, it’s almost everything.”

~ Paul Krugman

* * *

I will leave it there for the week. I will be in California next week and will see if the week produces inspiration for a new topic next week, more elaboration on this one, or the artificial intelligence piece I have been working on. But one way or the other, the Dividend Cafe awaits you as Q3 comes to an end.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet