Dear Valued Clients and Friends,

I am writing this week’s Dividend Cafe from my apartment in New York City very early on Friday morning, hours before I leave for an all-day symposium I have attended every year since 2009 (besides the COVID-cancelled years, of course). I mention this only because my philosophy of dealing with markets in the aftermath of exogenous shocks and, particularly, geopolitical events was heavily influenced by the historical realities taught to me at this very symposium over the years. I no longer learn anything new in attending; I just immensely benefit from the reinforcement. But this week, we have had an event so tragic, so reprehensible, so infuriating, and yet also one that requires me to reinforce myself (perhaps redundantly) the principles and best practices prudent investors must hold dear.

But I also brought up New York City because it had a terrorist event of its own back shortly after I entered the business, one which also profoundly impacted me. I have talked a lot in the past about the history of it and lessons learned. The 9/11 moment is, all at once, one of the seminal moments in my younger adult life, the very first shocking moment in my investment career, and an event obviously connected directly to New York City.

(You know, come to think of it, I was right here in March of 2020 as well when the COVID matter was becoming an American reality, and wrote about all of that then, too. There is just a deep association between memorable market moments in my life and my career with New York City).

My senior investment team joins me next week for a slew of annual meetings with our key portfolio manager and research-oriented relationships here in the city. This annual event has a lot of positive memories and deep value associated with it. The events of this week in Israel, the past memories of COVID, that moment of 9/11 – they do not. They are moments that either make the depths of human depravity incomprehensible to us or make investor anxiety pale in comparison to the human toll. And yet, through all the heartbreak and rage that an event like the Hamas slaughter of innocent Israeli families entails, we benefit from allowing history to speak.

So jump into this week’s Dividend Cafe, where I promise you will find more moral clarity than apparently can be found on most college campuses. But also, you will find today a history that informs us about the reality of investing in a fallen world, where sometimes unspeakable evil takes place. It isn’t meant to be an effort to cheer you up but is meant to inform and benefit you in your capacity as an investor.

|

Subscribe on |

Current lay of the land

For those who benefitted from being electronically unplugged from all television, internet, social media, and radio for the last seven days, America’s only democratic ally in the Middle East, Israel, was savagely attacked by the terrorist group Hamas last Saturday. Over 1,300 people were killed and 3,000 wounded. As of press time, 27 Americans are known to have been killed, and another 14 are missing, either presumed to have been taken hostage or worse. Another 97 Israelis are known to be hostages at this point, and the numbers are changing daily – not for the better.

If this were an isolated terrorist attack of savagery without deeper connections to other nation-states, without other geopolitical ramifications, without expected blowback from a highly capable and resourced nation that has a fervent and existential burden to protect herself, then maybe, just maybe, it would not be a market story, an investor story, and an economic story. Maybe then it would only be a story of hatred against the Jewish people, leading to savagery and the worst single-day murder of the Jewish people since the Holocaust. Maybe then it would be outside the Dividend Cafe as a pure human story. But it is more, or at least has the potential to be more, and therefore warrants some additional attention.

We’re all globalists now

As I type, we do not know what Israel’s intentions are in terms of next steps. Most decent people hope and pray they take the steps necessary to protect themselves, to obtain justice, and to punish the evildoers who would murder their families. But Israel is a nation of 9 million people surrounded by nations of 500 million people in the region. Their intent and commitment to protecting themselves will not be simple or easy, and it will not be isolated to Israel and Gaza. One way or the other, it is highly likely to escalate, to require Western and democratic support, and to involve other nation-states who do not get to hide behind the name of an obscure terror group like Hamas. In some form or another, other nations are going to be involved, I have to imagine.

As of press time, Israel (in keeping with the Geneva protocols they seem abundantly intent on honoring) has warned Palestinians to evacuate Northern Gaza, indicating a possible ground invasion coming. We simply do not know where this will go next.

But take note!

The market was 33,000 mid-day last Friday and is 33,850 mid-day as I write now. 850 points to the upside is not what many would have expected after this atrocity, yet of course, there are multi-causal explanations behind all this. Various earnings results, bond rate movements, Fed expectations, and other market factors and sentiments can always pull markets up or down in a given week. That bonds have rallied huge this week as yields have come down dramatically is really behind this equity market rally. But take note …

Oil. Don’t forget oil.

Oil went up +4-5% in the aftermath of the attacks, dropped a bit later in the week, and has come back to $86 as of press time. Oil between $75 and $90 is not the market-impact zone. Oil way down from here indicates massive global demand erosion (nowhere in sight) and/or massive global supply excess (nowhere in sight). Oil well above $90 from here may not come specifically because of Israel and Hamas but may very well come if Iran’s 3 million BPD capacity is knocked down to size. If the ability to move oil out of the region becomes a by-product of where certain things go. There are plenty of things that represent “upside risk” to oil, and they may or may not materialize. But the second, third, or fourth-order effects of this Middle East war certainly complicate the picture and, I believe, push the risk curve out for where oil prices go.

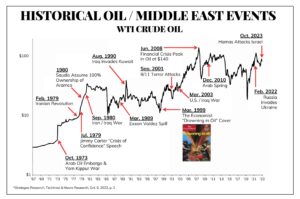

One chart’s message

There have been a plethora of world events in the last fifty years, a point that we are coming back to again shortly. Here, we have ample evidence of oil volatility around both economic and geopolitical events, especially Middle East ones. Oil has had periods of crashing around economic demand factors (2008, 2020) or excess supply factors (1999, 2014). It has spiked higher in times of invasion and distress (1980, 1990, 2010, 2022).

Oil’s journey is a crucial one in the present state of affairs for a lot of reasons, as I laid out last week before Hamas invaded Israel and caused a war. This ongoing reality is an economic one, a cultural war, a geopolitical one, and an ideological one, and it is but one example of where heightened Middle Eastern risk is relevant.

Contagion risk

I am used to talking about contagion risk in the context of debt markets – whereby one debt event hurts one party, and the hurt to that party impacts one of their counter-parties, which in turn hurts another counter-party to that counter-party who is seemingly not connected to the debt event at all. That is an example of a risk that becomes contagious. The challenge right now is more geopolitical contagion. Israel being attacked by Hamas and then attacking back in Gaza is not, in and of itself, a contagious event. Israel attacking Iran for the support it may have provided Hamas, is. Saudi supporting Israel in going after Iran may be; Qatar not supporting Israel may be; the U.S. being involved or not involved (either) carries some ramifications; what Russia does; what China does – these are all examples of contagion risk that may not come to bear at all (plenty of geopolitical events had contagion risk that never materialized) but that may veer this into another level of risk.

Don’t just do something, stand there

So why not get out of the way, sell risk assets, and let Israel do what she has to do? Allow me to bring up a very uncomfortable reality. Were there those who wanted to exterminate Israel from Earth before last Saturday? I hope you don’t need me to answer that question. Was there a risk of geopolitical escalation before last Saturday? Was there a possibility of something bad happening that brought about the risk of heightened response? Outside of the evil atrocity that I am discussing today (Hamas launching this barbarism against Israel), is evil and barbarism new? Was it there for the last fifty years, and will it be there for the next fifty years? What do we do about the reality of human nature?

Let’s start by accepting human nature – being aware of it – knowing that part of the lay of the land when it comes to investing. We invest in a risk premium structure (that is, we seek a premium return to that which is risk-free in exchange for, well, risk), and part of that risk premium structure are some immutable realities about human nature (on this side of glory) – namely, the existence of evil, the potential of barbarism, and of course a slew of other unpredictable possibilities.

History & Math

JUST isolated to the Middle East, not even talking about the Cold War or the gazillion other geopolitical events of relevance around the globe, since around the time I was born (give or take a tad) we have had the Munich Olympic massacre, the Yom Kippur War of 1973, a full revolution in Iran in 1979, U.S. hostages taken in Iran, a nearly decade-long war between Iraq and Iran, a decade (plus) long Civil War in Lebanon (that frequently lured the U.S. in in the 1980’s), more assassination of U.S. ambassadors than anyone seems to remember (Cyprus, Lebanon, Afghanistan, Libya), the assassination of Egyptian President Anwar Sadat, a plethora of hijackings of international infamy (TWA 1985, Achille Laura 1985, Abu Nidal, Pan Am 103, Air France 1994), the actual first Gulf War after Saddam Hussein’s invasion of Kuwait, the World Trade Center bombing of 1993, the attempted assassination of President Bush by Iraqi agents in 1993, hundreds (literally) of smaller failed attempts at terrorism around the globe whereby a mass incident was avoided but some attempt at human terror was perpetrated, the al-Qaeda bombing of the U.S. embassy in Nairobi in 1998, the al-Qaeda bombing of the U.S.S. Cole in Yemen in 2000, the 9/11 attacks on United States soil in 2001 (never forget!), the Afghanistan war that saw the Taliban removed from power, and then 20 years later come back to power, an unfathomable amount of suicide bombings and car bombings in the West Bank or Gaza perpetrated by Hamas or Hezbollah against Israel, the kidnapping and murder of WSJ reporter Daniel Pearl, the Palestinian intifada against Israel, the second Iraq war, the Shia insurgency in Yemen, the Arab Spring, the Syrian Civil War, the uprising of ISIS, the drone attacks on Saudi oil fields, and I am guessing a hundred other incidents (some major and some “minor” that I am forgetting). My memory is good but not that good. But do you think you have the idea yet?

And here are the numbers:

- 1970 Price Level of the S&P 500 Index: 92

- Current Price Level of the S&P 500 Index: 4,350 (up 45x)

- 1970 Earnings per share of the S&P 500 Index: $5.51/share

- Current Earnings per share of the S&P 500 Index: $220/share (up 40x)

- 1970 Dividends per share of the S&P 500 Index: $3.19

- Current Dividends per share of the S&P 500 Index: $70 (up 23x)

- Note this is all done in a 53-year period where inflation is up 8x, not 45x or 40x or 23x

But wait, there’s more

I have to point out – as much as my crucial and timeless principles are reinforced by the above empirical data, they actually tell an even better story about dividend growth than they do mere market behavior (well, I think it is both). The entry-level yield for the S&P in 1970 was 3.5%. It is 1.6% now. The index had a 58% dividend payout ratio then; it now has a 32% payout ratio. In other words, investors made 45x on their money in the index despite significant world turmoil for 50+ years.

Now imagine all of this in a 2023 context without the 20-30% of the index that pays no dividends, with isolated dividend growth, without entering at more than double the valuation (defined by dividend yield) that one entered in 1970. In other words, the math we are after (compounding dividend income and total returns) from current starting points seems unobtainable when the index is now where it is in dividend spirit and yield versus where it was in 1970. Imagine the gift intentionality presents!

Conclusion

I could have used all sorts of global turmoil to make the same point, but the Middle East is the story of this week and has been the story of many weeks for decades. It may be a bigger story (or not) in the months to come. Israel is our friend and ally, and I pray they are defended, supported, and protected – and I have no doubt they will aggressively defend, support, and protect themselves. History has a way of emboldening persecuted people.

But what I need to say for our clients and the investing public, who is my audience, since I don’t quite have the legitimacy or moral authority to say more on Israel, is that wherever this goes, a properly constructed portfolio has accounted for the potential zigs and zags. The reason for this violence is not new. And the portfolio resolution is not either.

Quote of the Week

“Those who value liberty for its own sake believe that to be free to choose, and not to be chosen for, is an inalienable ingredient in what makes human beings human.”

~ Isaiah Berlin

* * *

My prayers remain with the people of Israel.

And my professional focus remains on managing money towards the achievement of client goals with a knowledge of human nature and its underlying realities. To that end, we work.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet