Moving Day

I am guessing that most of us reading this article have moved at least once or twice in our lifetime. For me, I’ve moved four times over the last ten years.

I’ve become familiar with this feeling I get, that tinge of anxiety as I’m preparing for or staring down the barrel of a move. The organizing, the packing, the lifting, the loading, the unloading, the unpacking, etc. It’s a big undertaking.

Sometimes, that last box or two may remain unpacked for a year or so. It seems like the final period on the move tends to drag out.

I will say this, though, I’ve definitely matured as a mover. Good labeling and a solid process go a long way. This whole operation reminds me a lot of financial planning.

Respect the Process

I often mention that it’s “financial planning,” not a “financial plan,” to remind us that it’s a process, not an event. This means that you will spend your whole financial life planning – setting goals, adjusting, updating, setting new goals, pivoting, and so forth; there will always be another box to unpack.

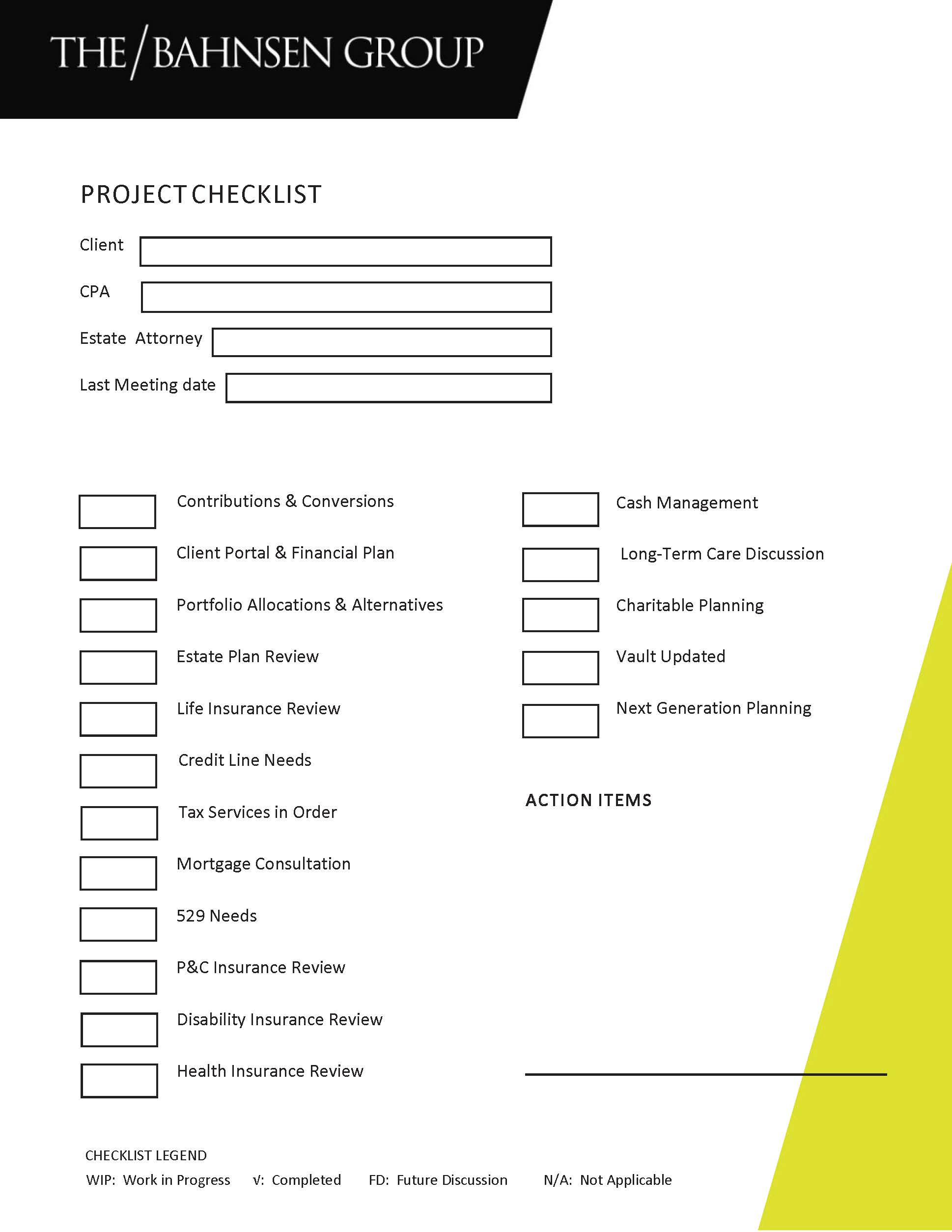

To help, I’ve really valued what I call my project checklist (see below). I’ll often tell clients that a huge part of my job is to help improve financial hygiene. So, I use this checklist to keep me on track and keep me aware of what needs attention.

Whether you are moving furniture and boxes or planning out your financial future, you need a clear and executable process.

Busy Versus Effective

Here’s what I’ve noticed about moving, it’s really easy to get distracted. The whole environment may just put you in an organizing mood, and you may find yourself alphabetizing your DVD collection or cleaning out your junk drawer. Sure, these things are important, but they are not mission-critical. Moving already takes a long time, you want to make sure not to get too distracted.

You could be doing effective and meaningful work, and be busy. The worst is when you are busy, but not working on something very impactful. We don’t want to mistake being busy for being on task.

When it comes to finances, we are all going to have our own little distractions. Some of us are obsessed with what’s going on in the economy, some revel in tax planning, and others may be enamored with investment selection. Whatever it is, I often see good things and important things become the main thing, which ultimately becomes a distraction. If one is looking at the project checklist, it’s easy to camp out on a box – a part of the process – that we enjoy, but this hinders us from jumping into the other hygiene matters that deserve our attention.

Again, the project checklist helps to build out the whole picture and encourages us to address tasks that are outside of our natural inclinations.

The Art of Prioritizing

Each of us is going to be planning around items that are key to us. We have our own preferences, needs, and goals, so the order of task execution will vary.

If you have a grand piano in your house, maybe you should start by devising a plan on how to move that. Some items in your move will be light, easy, and not require much of a plan – the grand piano will not be one of those items. Part of a solid process includes your ability to prioritize.

If you are terminally ill and have not established even a basic estate plan, then this should be a major priority. This would be something that should be addressed prior to portfolio design or tax planning. If you are buying a new home, maybe planning out the financing of this purchase would be prioritized over reviewing current life insurance policies. All this to say, there is an art to prioritizing.

One should sit down with an overview of potential planning items – like the project checklist – and literally pick out two or three items to tackle over the next three to six months. Then, you move on to the next tier of prioritized items. This is good planning.

Be Honest; Be Accountable

Nearly every time we’ve moved, we’ve had “that room.” You know, the room where I shovel all the boxes that I don’t want to unpack yet. I’m too tired; I’m just done moving. So, I create a little indoor garage space in our spare bedroom (or spare closet), where I stack a mix of unpacked boxes. Then, I shut the door – I definitely make sure to shut the door. Everything else is clean and tidy, and I don’t want this reminder of what’s still left to tackle.

At some point, I have to face reality; I have to be honest with myself and ultimately be accountable. I need to finish what I started and clear out that last room. Shutting the door might help me fool myself for a bit, but that undone work still exists – whether visible or not.

Your financial hygiene is no different; ignorance is not bliss. As important as what you have done is what you must do. Do you have an idea of what you are working on over the next three to six months? Financial planning is a process that benefits from compounding – the constant and consistent work builds on itself and creates a meaningful impact over time.

Now, Where to Start

Maybe this is all foreign to you. Maybe this all seems overwhelming. Don’t let it be. The best thing you can do is to simply start. Getting off the starting line can sometimes be the hardest part. So, pick one item that you want to tackle, mark it on your checklist as a “WIP” (work in progress), and get started. Soon enough, you can mark this item as completed, then just pick another item to start on. Rinse, wash, and repeat.

Don’t get stuck on the starting line. Those boxes aren’t going to pack themselves, and regardless of that slight feeling of anxiousness, you will feel better once you make a bit of progress. This is true for moving, and it’s absolutely true for financial planning.

With that said, there is no time like the present. I’ll let you go so you can get started now 🙂