Dear Valued Clients and Friends,

Greetings from New York City, where I will be leaving very early Friday morning to head back to California for a week and where I have been in meetings all week with our major money manager partners across every asset class in which we live. I had thought about doing today’s Dividend Cafe as a sort of recap of the week, but I am going to need the plane flight home to better organize 25 pages of notes and more decks than I know what to do with. I am in content overload mode at the moment, which is one of my favorite modes to be in (often times I am in Chinese food overload mode, so “too many charts” about the economy is far healthier than “too much fried rice”). I plan to really clean up my notes and takeaways and allow more organized thoughts to create a deliverable around this week’s findings. Brian Szytel and Kenny Molina are phenomenal Investment Committee partners, and we were all richly blessed by the conversations we enjoyed this week on interest rates, economic projections, housing, credit markets, relative value opportunities, and more. So, for those who want to tag along a bit on the week, stay tuned – more to come.

But that does leave me with a Dividend Cafe to write and not a whole lot of margin in which to write it. Luckily for me (and maybe for you??), a robust set of questions has come in that I have been sandbagging, and it seems like a good time to use Dividend Cafe to answer all of your latest and greatest questions. I am quite confident these questions that have come in will reflect things on the minds of many of you, so get ready for some good takes on such subjects as fears about interruption to dividend growth, minimum wage laws, velocity and inflation, dollar strength, China, and more on the Israel/Middle East situation (discussed in last week’s Dividend Cafe).

Get ready to jump into the Dividend Cafe …

|

Subscribe on |

My dog ate the dividend hike

“How do you think about ‘extraordinary items’ in terms of dividend performance? Is it as simple as they should be planned for and not impact rising dividends? Is there ever a circumstance that you would consider an extraordinary item as an appropriate excuse for not raising or even dare I say temporarily cutting a dividend?”

~ Adam V.

It’s a very fair question and one that is really important to the dividend growth strategy. There are certainly times we believe it may be the right thing to do for a company not to increase the dividend, and, yes, there are times it may be the right thing for a company to cut the dividend, but that does not mean it is the best thing for us to own it! The portfolio strategy necessarily centers around annual dividend growth devoid of the vulnerability cuts represented.

Now, an example of where recent dividend cuts did not phase us was when we entered one of the big bank companies post-financial crisis. We still own this company to this day, and when we entered in 2009 or so, it was clear to us that (a) The Federal Reserve forced this company’s 2008 dividend cut, (b) The Fed’s stress tests were allowing the resumption of the company dividend, and (c) The company itself was highly committed to ongoing dividend growth. Suffice it to say, we were right. But that is a company we did not own when the Fed made them reduce their dividend and rather one we added post-financial crisis. We have to be forward-looking and yet discerning around the lessons of the past. Yes, a company’s dividend history is highly informative, but we allow for nuance and particulars to influence decision-making.

That said, and this is the most important part of this answer – the idea that a given event (like a cyber attack or some other idiosyncratic business interruption) should be an excuse for a dividend cut is generally unacceptable, and the very reason we demand financial stability, balance sheet strength, repeatability of cash flow, and other such combinations of circumstances to inform our process. In 2020, we had two major oil and gas companies maintain (and grow) their dividend through the shutdown of the world economy and $0 oil prices. That was not because they were magically immune to the brutality of what was happening – their business was ravaged – but because they had the balance sheet strength and discretion over capex to make it work. In 2023, we have a company that is a major turnaround project that has maintained and grown their dividend for now through a very painful time for the company and yet has had the assets on the balance sheet to allow such while they reduce debt and take expenses out of their cost structure.

In other words, we do not have as a criteria for buying a company; “they will not have tough times.” That strikes us as rather naive. Instead, we prefer the criteria, “they have a path to durability through tough times.”

The dollar’s reserve currency status

“I’ve recently read a few things about moves that China and Russia are making to end the dollar’s status as the world’s reserve currency (along with other nations concerned that the U.S. might one day cut them out of the international banking system, as with Russia over Ukraine). I wonder if this might merit some comment.”

~ Jeff P.

I think it is a given that China and Russia would love for the U.S. dollar to not be the world’s reserve currency. Particularly China, where the U.S. runs a current account deficit and settles it with dollars (i.e., we buy more from them than they buy from us, so we owe dollars – our currency – to settle the difference, giving us a lot of control over the economic relationship since we can manipulate the currency to our benefit). But I also want a lot of things that I have no ability to effectuate, and let’s just say that I have a better chance of effectuating some of the things I want China or Russia to do of stripping the dollar of currency reserve status. “Want” and “intent” are not the same as “effect.” And no, I do not believe they are “making moves” to end the dollar’s reserve status.

At the core of this issue is a distinction between “reserve” currency and “transactional” currency. A Middle Eastern country and China might transact 0.01% of oil activity in Yuan versus dollars, but how do countries HOLD reserves after transactions? Find me a country that wants to hold its foreign exchange reserves in a currency that can’t freely move in and out of countries. It doesn’t and never will exist. The free flow of trade, labor, and capital is a sine qua non for a reserve currency, period.

I do believe Sam Rines of Corbu Research offers unimprovable insights here on the subject.

I’ll have fries with that

“California Governor, Gavin Newsom, recently signed a bill increasing the minimum wage for fast food workers to $20/hour. What are your thoughts on this and what do you see as some of the ramifications?”

~ Chris A.

At the risk of sounding political, which my answer most certainly is not, the most objective and purely macroeconomic answer to this question is that I think we all absolutely know the answer to this. Even apart from one Governor, one state, and one industry, far and wide, attempts to set the cost of something above the market-clearing price to incentivize alternatives. The kiosk reality at fast food restaurants has accelerated at light speed in recent years, and the total cost of labor in the fast food industry is going down even as unit labor costs from mandatory wage increases have gone up. Simply put, the industry responds to things like this with rational use of technology and efficiency to avoid the inefficiency of a price distortion. Rinse and repeat.

Let’s make a deal

“With the dollar strength, shouldn’t we start seeing imports increase? And with that, more treasuries being purchased by those countries that we are importing more from? If this isn’t the case, why not? And what would drive more imports to the U.S.?”

~ Scott B.

In theory, this is fine as it goes – a stronger dollar increases the benefit for exporters and therefore means for us on the U.S. side, imports ought to go higher. And yes, when we run a trade deficit with a country, they will end up receiving dollars. However, this all depends not on volatility and cyclicality but more embedded trends. There is a lag effect, and it takes things settling and time for these conditions to ring true.

But it also requires something beyond the theoretical – and that is economic strength. Imports + exports require economic activity, and if total trade declines because China is weakening or, the U.S. is weakening or the global economy is weakening, that “delta” between exports and imports means a lot less. The total sum must be growing for the “delta” to result in meaningful additions to dollar purchases from foreign countries.

I would add – China may have slowed their treasury purchases a tad, but let’s be clear -they have bought $75 billion of Fannie Mae bonds this year with dollars. The story is never as simple as people want it to be.

More than enough money going around

“I thought that the reason China was making a deal with Middle East oil producers was to both destabilize the USD, and attempt to remove USD as the reserve currency? Is it true that you believe that even after large China demand for oil was satisfied with USD there were still excess dollars (going to buying U.S. bonds)?”

~ Burt B.

Yes, no question about it. This was true for decades and allowed China to run up $1 trillion of U.S. dollar-denominated assets in Treasuries alone. They are still buying Treasuries and, as mentioned above, agency bonds as well.

Money where my mouth is

“I am curious as to what your allocation position might be if this Israel/Hamas incursion escalates to a point where there are several different bad actors that escalate this to a breaking point for all involved. Recent events have literally scared me in regard to an all out fight for the freedom of this country and the world. I understand the pressure that you and all in the financial industry must feel at this moment, but just looking for your position, if all hell breaks loose.”

~ Gary C.

If “all hell broke loose” and things got a lot worse, we would definitely be looking to add to risk positions. Obviously, as an investor, I would love for things to get a lot worse (being opportunistic and long-term), but as a human being, I would never want things to worsen if it meant the loss of human life, which I think is the subject of distress you are referring to. So, even though I always root for bad markets and challenging economic circumstances (where money is really made for investors), I don’t favor geopolitical disruptions as a way of getting there. But there will be some of those, if not now, later. And we will be adding to the risk when it happens.

The timing of market payments

“Does it matter when the ex-dividend date is when one buys a dividend stock?”

~ Steve A.

No, it does not. The market is not dumb. It is pricing in the second-by-second reality of when a dividend is included or when it is not.

Japan the Sequel?

“China increasingly reminds me a lot of 1990’s Japan:

- Bad debt dynamics across the whole economy

- Over-allocation of capital to low/negative productivity real estate

- Demographics in per-capita GDP and workforce population aging

- Unreliable economic data

- Cushioned by large foreign currency reserves and low exposure to international creditors

It all looks like a long-term stagnation story, economically. More broadly, though, it’s a lot more dangerous to the U.S. and the world given China’s massive military and the regime’s reliance on whipping up nationalism as a means to retain legitimacy. Your thoughts?

~ Michael P.

There are definitely significant differences in the China-now versus Japan-then story, too, but the similarities are the key, and I agree with the general framework you have outlined above.

The entire question to me is to what extent China will pursue fiscal and monetary solutions to those similarities in line with the way Japan did. I wrote a couple of months ago and have seen more validation since they will be lured into various fiscal interventions that will look like Japan, yet the monetary playbook they will use is not entirely clear to me.

Chart of the Week

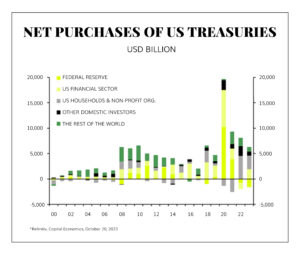

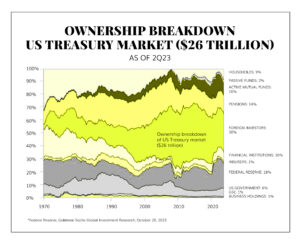

There are two charts today that tie into several of the questions and topics addressed this week and that have been part of my consistent messaging for some time now. What one sees in the top chart in terms of Federal Reserve activity in the bond market is very stark – the darker yellow space shows a huge buyer of bonds turning into a seller. It is that simple in terms of what has now impacted yields on the long end of the curve. The bottom chart reinforces the economics behind bond purchasers over time and the logic in how that impacts rates.

(h/t Michael Poulos)

Quote of the Week

“A false faith is capable of terrible and monstrous things.”

~ Dietrich Bonhoeffer

* * *

Back to California, I go. Have a wonderful weekend, and please reach out with any questions at any time. And please, USC, beat Utah.

With regards,

David L. Bahnsen

Chief Investment Officer, Managing Partner

dbahnsen@thebahnsengroup.com

The Bahnsen Group

thebahnsengroup.com

This week’s Dividend Cafe features research from S&P, Baird, Barclays, Goldman Sachs, and the IRN research platform of FactSet